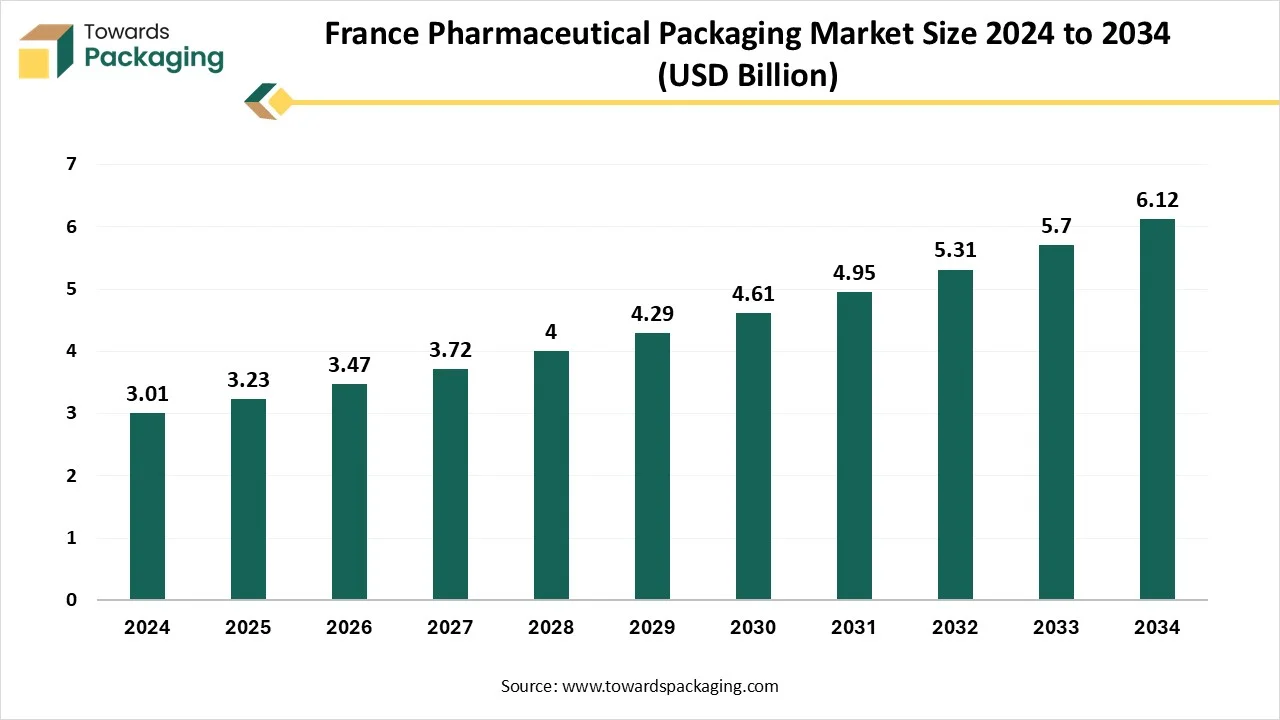

France Pharmaceutical Packaging Market Worth USD 6.12 Bn by 2034

As highlighted by Towards Packaging research, the global France pharmaceutical packaging market, to rise from USD 3.47 billion in 2026, is expected to reach USD 6.12 billion by 2034, registering a CAGR of 7.35% throughout the forecast period.

Ottawa, Oct. 02, 2025 (GLOBE NEWSWIRE) -- The global France pharmaceutical packaging market was assessed at USD 3.23 billion in 2025, with projections indicating an increase to USD 6.12 billion by 2034, based on insights from Towards Packaging, a sister firm of Precedence Research.

The market is experiencing steady growth, driven by an increasing demand for safe, sustainable, and innovative packaging solutions. Rising awareness of product safety, strict regulatory standards, and the growth of the pharmaceutical industry are key factors shaping the market. The demand for advanced packaging materials, including plastics, glass, and sustainable alternatives, is growing. Additionally, technological innovations, automation, and the rising adoption of smart packaging solutions are enhancing efficiency and reducing risks, making France a significant hub for pharmaceutical packaging development and innovation.

What is meant by Pharmaceutical Packaging?

Pharmaceutical packaging refers to the process and materials used to enclose and protect pharmaceutical products, such as medicines, vaccines, and medical devices, from contamination, damage, and deterioration. It ensures product safety, stability, and integrity throughout the supply chain, from manufacturing to end-user consumption.

Packaging also plays a crucial role in providing essential information, including dosage instructions, expiry dates, and regulatory compliance details. Modern pharmaceutical packaging incorporates innovative materials, such as plastics, glass, and biodegradable options, along with technologies like tamper-evident seals, child-resistant closures, and smart labeling. Overall, it safeguards patient health while supporting efficient distribution and compliance with stringent regulatory standards.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5704

What are the Latest Trends in the France Pharmaceutical Packaging Market?

- Sustainability Trends: A significant shift is underway toward eco-friendly materials, including biodegradable plastics and recyclable packaging, to minimize environmental impact.

- Rise of Smart Packaging: Integration of technologies like RFID, QR codes, and sensors enhances traceability, patient compliance, and counterfeit prevention.

- Child-Resistant and Senior-Friendly Designs: Packaging is designed to be both secure for children and accessible for seniors, striking a balance between safety and usability.

- Personalized Packaging: Customization of packaging to cater to individual patient needs and preferences is on the rise.

-

Regulatory Compliance and Serialization: Adherence to stringent regulations and the implementation of serialization ensure product authenticity and safety.

What Potentiates the Growth of the France Pharmaceutical Packaging Market?

Technological Advancements & Regulatory Compliance

Regulatory compliance and technological advancements are pivotal drivers of growth in the France pharmaceutical packaging market. In 2025, France introduced stringent Extended Producer Responsibility (EPR) regulations, mandating that all industrial and commercial packaging, including pharmaceutical packaging, comply with recycling and sustainability standards. This regulatory shift compels manufacturers to adopt advanced smart packaging solutions that are integrated with IoT and blockchain technologies, ensuring not only compliance but also enhanced traceability and security. For instance, the implementation of secure QR codes and RFID tags in packaging helps authenticate products and prevent counterfeiting, aligning with both regulatory requirements and technological advancements. These developments underscore the critical role of regulatory compliance and technology in shaping the future of pharmaceutical packaging in France.

-

In 2025, the European Union adopted the new Packaging and Packaging Waste Regulation (PPWR / Packaging Regulation 2025/40), which entered into force on 11 February 2025, with most provisions taking effect from 12 August 2026. This law strictly regulates packaging design, reusability, recyclability, and Extended Producer Responsibility (EPR) across all member states. At the same time, LOG Pharma Primary Packaging introduced innovative eco-barrier bottles at Pharmapack Europe 2025. These bottles are lightweight, sustainable, and designed to block oxygen and moisture, directly addressing regulatory requirements while incorporating technological innovation.

If there is anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

Limitations & Challenges in the French Pharmaceutical Packaging Market

Counterfeiting Risks & Environmental Concerns

The key players operating in the market are facing issues due to environmental concerns and counterfeiting risks. Strict waste management and recycling rules restrict the use of conventional packaging materials. The demand for advanced anti-tampering and authentication features increases production costs.

Country-Level Insights

The France pharmaceutical packaging market is experiencing significant growth, driven by several key factors. The aging population and increasing prevalence of chronic diseases, such as diabetes and cardiovascular conditions, are escalating the demand for medications, thereby boosting the need for pharmaceutical packaging solutions. Additionally, the rise of biologics and personalized medicines necessitates specialized, sterile, and temperature-controlled packaging systems to ensure the stability and efficacy of the drugs. Regulatory compliance is another critical driver; stringent regulations, including the EU's Falsified Medicines Directive, require tamper-evident and child-resistant packaging, prompting innovation in packaging technologies.

Moreover, France's commitment to sustainability is influencing packaging choices, with a growing emphasis on eco-friendly materials and recyclable packaging solutions. Investments by major pharmaceutical companies, such as Sanofi's €1.08 billion investment to enhance drug production in France, are further strengthening the domestic pharmaceutical manufacturing capabilities, thereby increasing the demand for pharmaceutical packaging.

More Insights of Towards Packaging:

- Pressure-Sensitive Labelling Solutions for Pharmaceutical Market Size, Share & Growth Projections - The pressure-sensitive labelling solutions for pharmaceutical market is accelerating, with forecasts predicting hundreds of millions in revenue growth.

- Pharmaceutical Polymer Vials Market Growth, Innovations and Market Size Forecast 2034 - The pharmaceutical polymer vials market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- PCTFE Pharmaceutical Packaging Films Market 2025 Share, Trends, and Forecast at 5.3% CAGR to 2034 - The PCTFE pharmaceutical packaging films market is set to grow from USD 1000.35 million in 2025 to USD 1592.24 million by 2034.

- Pharmaceutical Sterile Sample Bags Market Report From USD 1.53 Bn in 2025 to USD 1.88 Bn by 2034 with Smart Packaging Growth - The pharmaceutical sterile sample bags market is projected to reach USD 1.88 billion by 2034, expanding from USD 1.53 billion in 2025.

- Reusable Cold Chain Packaging Market Trends 2025 Highlight Growth in Pharma E-commerce and IoT Integration - The global reusable cold chain packaging market is expected to grow from USD 4.97 billion in 2025 to USD 9.13 billion by 2034.

- Corrugated Packaging for Pharmaceutical Market Drives at 6.54% CAGR (2025-34) - The global corrugated packaging for pharmaceutical market is forecast to grow at a CAGR of 6.54%, from USD 9.12 billion in 2025 to USD 16.13 billion by 2034.

- U.S. Pharmaceutical Packaging Market Drives at 7.36% CAGR (2025-34) - The global U.S. pharmaceutical packaging market is predicted to expand from USD 52.48 billion in 2025 to USD 99.44 billion by 2034.

- Canada Pharmaceutical Packaging Market Drives at 7% CAGR (2025-34) - The Canada pharmaceutical packaging market is expected to increase from USD 7.53 billion in 2025 to USD 14.43 billion by 2034.

- PET Packaging in Pharmaceutical Market Trends 2025: Stretch Blow Molding and Blister Packs Propel Rapid Growth - The PET packaging in the pharmaceutical market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034.

- UAE Ampoules Packaging Market 2025: Growth Boosted by Smart Packaging & Pharmaceutical Surge - The UAE ampoules packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- Disc Top Caps Market to Witness Robust Growth by 2034 | Personal Care & Pharma Packaging Demand Surges - The global disc top caps market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034.

- Pharmaceutical Tube Packaging Market Growth Fueled by AI, Personalized Medicine & Clean Label Trends - The pharmaceutical tube packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- Pharmaceutical Packaging Machines Market Driven by AI, Smart Tech, and USD 13.63 Billion Forecast - The pharmaceutical packaging machines market is expected to increase from USD 7.04 billion in 2025 to USD 13.63 billion by 2034.

- Smart Containers Market Enhance Cold Chain Safety in Food & Pharmaceuticals - The smart containers market is projected to reach USD 30.73 billion by 2034, expanding from USD 6.07 billion in 2025, at an annual growth rate of 19.63% during the forecast period.

-

U.S. 503B Compounding Pharmacy Packaging Market Size and Insights - The U.S. 503B compounding pharmacy packaging market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034.

Segment Outlook

Packaging Type Insights

The blister pack segment dominated the France pharmaceutical packaging market in 2024 because blister packs provide excellent protection against moisture, oxygen, and contamination, ensuring a longer shelf life for tablets and capsules. They are also cost-effective and highly efficient for mass production, allowing unit-dosing and easy visual inspection. Their tamper-evident nature, patient convenience (clear individual doses and calendar blisters), and alignment with stringent regulatory standards further reinforce their dominance in France.

The prefilled syringes & cartridges segment is expected to grow at the fastest rate in the coming years due to several converging trends. The growing demand for biologics and injectable therapies necessitates packaging that ensures sterility, precise dosing, and ease of use. Prefilled formats reduce the risk of contamination and dosing errors, which both regulators and patients favor. The aging population and the rise in chronic diseases mean that more patients require frequent injections, thereby increasing demand for specialty packaging solutions. Also, innovations in materials (glass vs advanced polymers), ergonomics, auto-disable features, and convenience are making prefilled syringes more attractive than traditional vials.

Material Insights

The plastic segment dominated the France pharmaceutical packaging market in 2024 for several reasons. Firstly, plastics like PET, PP, and HDPE are cheaper to produce and lighter than alternatives, reducing shipping and production expenses. Second, plastics offer versatility and durability, as they are resistant to moisture, chemicals, impact, and temperature changes, which is important for preserving drug stability. Third, they allow for easy shaping and customization (bottles, blister films, syringes, containers), which supports a variety of dosage forms. Finally, plastics are being increasingly engineered for improved barrier performance and recyclability to meet regulatory and sustainability demands, thereby maintaining their market appeal.

The glass segment is likely to grow at the fastest CAGR in the upcoming period. Glass offers superior chemical inertness, preserving the stability and efficacy of biologics, vaccines, and injectable drugs without risk of leaching or reaction. It exhibits excellent barrier properties against moisture, oxygen, and light, which are critical for sensitive formulations. Recent regulatory focus on sustainability and minimizing plastic use has also made recyclable glass more attractive. Notably, SGD Pharma has enhanced its capabilities in 2024-2025 by introducing a new siliconization line for Type I glass vials, aiming to improve compatibility and minimize drug-container interactions.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Drug Delivery Mode Insights

The oral drugs segment dominated the market in 2024. Oral drugs like tablets, capsules, and solids are more commonly prescribed and consumed than injectables or inhalables, resulting in larger volume packaging needs. Their packaging is less complex and expensive than sterile injectable formats, making oral packaging cost-effective. Additionally, the shelf stability of solids reduces the need for stringent cold-chain or barrier requirements. Patients prefer ease of administration and portability, which oral dosage forms provide. Regulatory approvals tend to be simpler, and manufacturers benefit from established mass production lines for oral dosage packaging. This mix of high demand, simplicity, cost-efficiency, and patient convenience drives the dominance of the oral drug segment.

The injectable and inhalable drugs segment is expected to expand at the fastest rate in the market due to the rising demand for biologics, vaccines, and advanced therapies that require sterile delivery. Prefilled syringes, auto-injectors, and inhalable devices enhance patient convenience and adherence, particularly for chronic illnesses and home-care treatments. Regulatory requirements for precise dosing, safety, and contamination prevention drive packaging innovations. Additionally, the growth of connected health tools and the expanding market for generic injectables further contributes to the rapid adoption of these delivery modes.

Product Type Insights

The generic drugs segment dominated the France pharmaceutical packaging market due to several key factors. Generic drugs offer significant cost savings, typically around 60% less than branded counterparts, making them highly attractive to both healthcare providers and patients. France's healthcare system actively promotes the use of generics through favorable reimbursement policies and incentives for pharmacists to substitute branded medications with generic alternatives. Additionally, France's well-established regulatory framework facilitates the swift approval and market entry of generic drugs, fostering a competitive landscape that encourages market growth. The widespread adoption of generics contributes to substantial healthcare savings, further driving their dominance in the pharmaceutical packaging sector.

The biologic segment is expected to expand at the fastest CAGR over the forecast period due to the increasing demand for vaccines, monoclonal antibodies, and protein-based therapies. These products require specialized, sterile, and temperature-controlled packaging solutions to ensure stability and efficacy, driving innovation in prefilled syringes, vials, and advanced containment systems.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

End-Use Insights

The pharmaceutical manufacturer segment dominated the France pharmaceutical packaging market in 2024, as manufacturers require large-scale, reliable, and compliant packaging solutions to ensure product safety, stability, and regulatory adherence. Their demand for diverse packaging formats, including blister packs, vials, prefilled syringes, and bottles, combined with investments in automation, smart labeling, and sustainable materials, reinforces their dominance in driving market growth.

The contract packaging organizations (CPO) segment is expected to grow at the fastest rate due to rising outsourcing trends among pharmaceutical companies seeking cost efficiency, specialized expertise, and faster time-to-market. CPOs provide advanced packaging technologies, regulatory compliance support, and flexible production capacities, enabling manufacturers to focus on R&D while ensuring high-quality, safe, and innovative packaging solutions for a diverse range of pharmaceutical products.

Recent Breakthroughs in France Pharmaceutical Packaging Market:

- In 2025, Pharmapack Europe 2025, held in Paris, convened leading stakeholders in pharma packaging and drug delivery to spotlight sustainability, contract packaging, device innovation, and large-volume injectables. SHL Medical, awarded for its Elexy™ electromechanical autoinjector, and Kymanox shared insights on emerging technologies, collaboration strategies, regulatory hurdles, and the evolving role of delivery devices as differentiators in the market.

- In February 2025, MM Packaging received the EcoVadis Platinum Medal for sustainability in recognition of the performance of its pharmaceutical packaging facilities in France, marking the fifth time these facilities have received this honor. EcoVadis, a sustainability benchmarking organization, conducted the assessment that takes into account every facet of sustainability under the framework of policies, actions, and outcomes. With this accomplishment, MM Packaging's. This list includes five pharmaceutical packaging production sites throughout France and includes the top 1% of companies evaluated worldwide.

Access our exclusive, data-rich dashboard dedicated to the France Pharmaceutical Packaging Market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access Now: https://www.towardspackaging.com/contact-us

France Pharmaceutical Packaging Market Top Players

- Amcor Plc

- Gerresheimer AG

- Schott AG

- Aptar

- Berry Global Inc.

- West Pharmaceutical Services, Inc.

- SGD Pharma

- Catalent, Inc.

- IPACKCHEM

- Bormioli Pharma

- RPC Group (Berry Global)

- Nemera

- Albea Group

- Clariant AG

- Mondi Group

- Nipro Corporation

- WestRock Company

- Stevanato Group

- Constantia Flexibles

- Faubel Pharma Services

- Huhtamaki Group

France Pharmaceutical Packaging Market Segments

By Packaging Type

- Primary Packaging

- Blister Packs

- Bottles

- Vials & Ampoules

- Prefilled Syringes & Cartridges

- Pouches

- Tubes

- Secondary Packaging

- Folding Cartons

- Labels

- Shrink Wraps

- Tertiary Packaging

- Corrugated Boxes

- Pallets & Crates

By Material

- Plastic (HDPE, PET, PVC, PP)

- Glass

- Paper & Paperboard

- Aluminium Foil

- Others (Biopolymers, Rubber)

By Drug Delivery Mode

- Oral Drugs

- Injectable Drugs

- Topical/Transdermal Drugs

- Inhalable Drugs

- Ophthalmic & Nasal Drugs

By Product Type

- Branded Drugs

- Generic Drugs

- Biologics

By End-Use

- Pharmaceutical Manufacturing

- Contract Packaging Organizations (CPOs)

- Retail Pharmacies

- Hospitals & Clinics

- Research & Development Centres

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/price/5704

Become a Valued Research Partner with Us - Schedule a meeting: https://www.towardspackaging.com/schedule-meeting

Request a Custom Case Study Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Towards Packaging, Your Trusted Research and Consulting Partner, Has Been Featured Across Influential Industry Portals - Explore the Coverage:

- Flexible Packaging Market - PACKNODE

- Is it finally safe to ditch your phone case? I put it to the test

- Battery Brands Charge Forward with Plastic-Free Packaging

- Why Non-corrugated Boxes Are the Future of Packaging

- Ampoules Packaging Market Size Expected to Reach $11.27 Bn by 2034

- Flexible plastic pouches projected to boom over the next decade

- GLOBAL PET FOOD PACKAGING MARKET SET TO DOUBLE BY 2032

- The Skinny on the Skin Packaging Market

- Healthcare Goes Green & Sterile

- The Different Types of Adhesives for Paper Packaging

-

Child-Resistant Packaging: Cannabis and So Much More

Towards Packaging Releases Its Latest Insight - Check It Out:

- U.S. 503A Compounding Pharmacy Packaging Market Size and Insights

- Cell Culture Media Storage Containers Market Set to Triple by 2034: AI and Biopharma Drive Demand

- CDMO Packaging Market Set to Soar in 2025 as Pharma Outsourcing and Biologics Drive Explosive Growth

- Compound Pharmacy Packaging Market Size and Insights

- Sustainable Pharmaceutical Packaging Market Growth, Innovations, and Market Size Forecast 2034

- Aseptic Packaging for the Pharmaceutical Market Size, Trends, Share, and Innovations 2034

- Pharmacy Repackaging System Market 2025: Smart Packaging Meets Compliance in a Digital Healthcare

- Pharmaceutical Stand Up Pouches Market Growth Drivers, Challenges and Opportunities

- PTP Aluminum Foil for Pharmaceutical Package Market Insights, Trends and Forecast

- Pharmaceutical Cold Chain Logistics Packaging Market Size & Growth Forecast 2034

- Pharmaceutical APET Film Market Research, Consumer Behavior, Demand and Forecast

- Pharmaceutical Bottles Market Driven by Sustainability

- Pharmaceutical and Chemical Aluminum Bottles and Cans Market Strategic Insights for 2034

- Pharmaceutical Containers Market Size: USD 188.74 Bn by 2034

-

Pharmaceutical Glass Packaging Market Sustainability & Circular Economy Data

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.