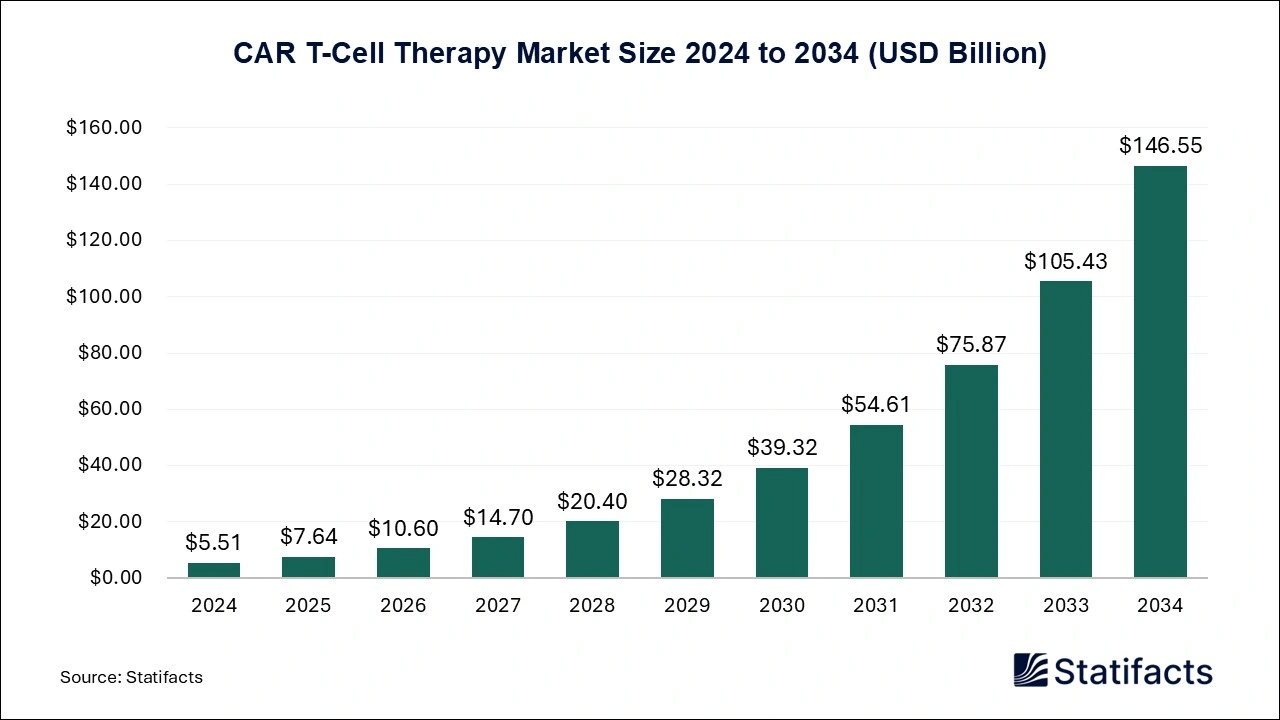

CAR T-Cell Therapy Market Size to Surpass USD 146.55 Billion by 2034 Fueled by Innovations in Cancer Treatment and Growing Demand for Personalized Therapies

The global car t-cell therapy market size is predicted to increase from USD 7.64 billion in 2025 and is anticipated to be worth around USD 146.55 billion by 2034, expanding at a CAGR of 38.83% from 2025 to 2034. A study published by Statifacts a sister firm of Precedence Research.

Ottawa, Oct. 30, 2025 (GLOBE NEWSWIRE) -- According to Statifacts, the global car t-cell therapy market size reached USD 5.51 billion in 2024 and is estimated to attain USD 146.55 billion by 2034, growing at a CAGR of 38.83% during the forecast period from 2025 to 2034. Robust product pipeline with regulatory approvals across geographies, increasing inclination towards targeted treatment, and growing cases of cancer malignancies across the population, driving the growth of the market.

This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.statifacts.com/stats/databook-download/8510

CAR T-Cell Therapy Market Highlights

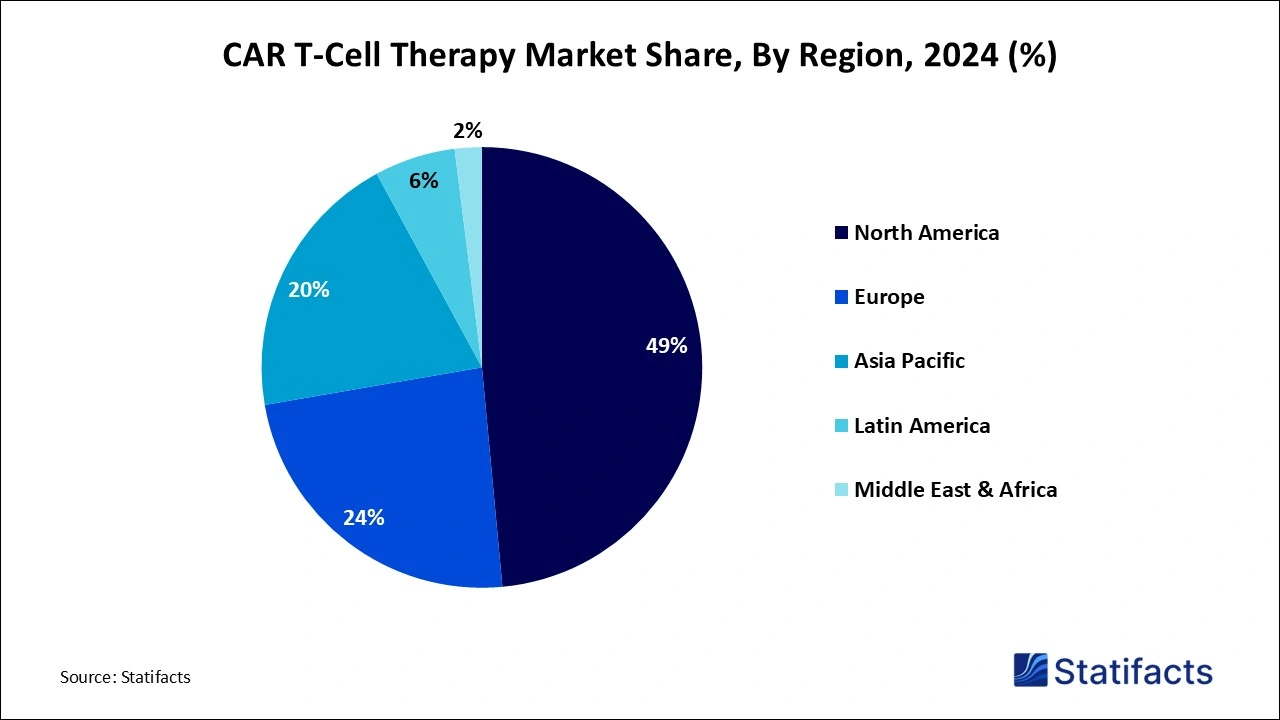

- North America led the CAR T-cell therapy market in 2024, holding a dominant revenue share of 49%, and is expected to maintain its leadership, driven by advanced healthcare infrastructure and robust investments in cancer treatment research.

- Asia-Pacific is projected to witness the fastest growth, with a remarkable CAGR of 40.22% from 2025 to 2034, fueled by increasing healthcare expenditure and advancements in cellular therapies in key regions such as China and India.

- The CD19 target antigen segment led the market in 2024, capturing a significant share of 63%, and is expected to maintain its dominance, owing to the widespread application of CD19-targeted therapies in treating hematologic cancers.

- The BCMA (B-cell maturation antigen) segment is anticipated to experience substantial growth, with an expected CAGR of 46.15% from 2025 to 2034, driven by its promising results in treating multiple myeloma and other blood cancers.

- The hematologic malignancies segment dominated the CAR T-cell therapy market in 2024, accounting for 94% of the market share, and is expected to continue leading, driven by the high efficacy of CAR-T therapies in treating blood cancers.

- The solid tumors segment is projected to grow at a significant CAGR of 45.68% from 2025 to 2034, fueled by increasing research and clinical trials aimed at expanding CAR-T therapy's applicability to solid cancer types.

- Autologous CAR-T cell therapy held the largest market share of 80% in 2024 and is expected to remain the preferred method, due to its personalized treatment approach and proven efficacy in patients with hematologic malignancies.

- Allogeneic CAR-T cell therapy is anticipated to grow at a notable CAGR of 44.35% from 2025 to 2034, driven by advancements in off-the-shelf therapies that offer more accessible and cost-effective treatment options.

- The viral vectors segment led the market in 2024, capturing a 66% share, and is expected to continue to dominate, as viral vectors are the most established method for delivering CAR-T cells into patients' immune systems.

- Centralized manufacturing dominated the CAR T-cell therapy market in 2024, holding a 54% market share, and is likely to maintain this position, driven by its streamlined production processes and quality control advantages.

- The in vivo CAR-T therapy segment is expected to experience rapid growth, with a projected CAGR of 47.28%, as it holds potential for reducing production time and improving the scalability of CAR-T therapies.

- The hospitals segment held a significant market share of 44% in 2024, and is anticipated to continue leading, driven by the increasing adoption of CAR-T therapies in clinical settings for cancer treatment.

CAR T-Cell Therapy Market Size, by Region, 2022 to 2026 (USD Million)

| Region | 2022 | 2023 | 2024 | 2025 | 2026 |

| North America | 1,409.80 | 1,950.03 | 2,698.76 | 3,735.99 | 5,173.29 |

| Europe | 671.81 | 935.02 | 1,302.05 | 1,813.61 | 2,526.81 |

| Asia Pacific | 557.73 | 781.95 | 1,096.75 | 1,538.51 | 2,158.52 |

| Latin America | 169.33 | 226.63 | 303.12 | 405.01 | 540.51 |

| Middle East & Africa | 61.30 | 82.37 | 110.64 | 148.50 | 199.16 |

CAR T-Cell Therapy Market Size, by Target Antigen, 2022 to 2026 (USD Million)

| Region | 2022 | 2023 | 2024 | 2025 | 2026 |

| CD19 | 1,907.98 | 2,570.13 | 3,461.03 | 4,657.84 | 6,264.21 |

| BCMA (B-cell Maturation Antigen) | 380.18 | 575.60 | 865.76 | 1,294.66 | 1,926.51 |

| CD22 | 180.32 | 252.40 | 353.43 | 495.01 | 693.43 |

| GD2 | 98.96 | 142.28 | 204.43 | 293.46 | 420.94 |

| HER2 | 61.50 | 92.12 | 137.28 | 203.67 | 300.96 |

| GPC3 | 50.60 | 75.85 | 113.13 | 167.95 | 248.33 |

| Others (e.g., EGFRvIII, CD7, CD123, mesothelin) | 190.42 | 267.63 | 376.26 | 529.04 | 743.91 |

CAR T-Cell Therapy Market Size, by Indication / Disease Type, 2022 to 2026 (USD Million)

| Region | 2022 | 2023 | 2024 | 2025 | 2026 |

| Hematologic Malignancies | 2,723.16 | 3,755.39 | 5,181.63 | 7,151.37 | 9,872.40 |

| Solid Tumors | 146.80 | 220.61 | 329.70 | 490.26 | 725.89 |

CAR T-Cell Therapy Market Size, by Type of Therapy, 2022 to 2026 (USD Million)

| Region | 2022 | 2023 | 2024 | 2025 | 2026 |

| Autologous CAR T-cell Therapy | 2,369.60 | 3,239.39 | 4,430.16 | 6,059.29 | 8,288.36 |

| Allogeneic CAR T-cell Therapy | 500.37 | 736.61 | 1,081.17 | 1,582.34 | 2,309.93 |

CAR T-Cell Therapy Market Size, by Technology / Vector Used, 2022 to 2026 (USD Million)

| Region | 2022 | 2023 | 2024 | 2025 | 2026 |

| Viral Vectors | 1,979.87 | 2,685.51 | 3,643.01 | 4,940.90 | 6,699.71 |

| Non-viral Vectors | 463.66 | 674.45 | 979.38 | 1,419.64 | 2,054.48 |

| Armored CAR T-Cells (enhanced T-cell persistence/activity) | 174.01 | 256.37 | 376.58 | 551.55 | 805.74 |

| Dual/Multiple Antigen Targeting CAR T-Cells | 179.30 | 255.91 | 365.15 | 520.73 | 742.23 |

| Safety Switch-Equipped CAR T Cells | 73.13 | 103.75 | 147.21 | 208.82 | 296.13 |

CAR T-Cell Therapy Market Size, by Manufacturing/Delivery Method, 2022 to 2026 (USD Million)

| Region | 2022 | 2023 | 2024 | 2025 | 2026 |

| Point-of-Care Manufacturing | 743.58 | 1,035.05 | 1,441.53 | 2,008.17 | 2,798.25 |

| Centralized Manufacturing | 1,585.40 | 2,165.05 | 2,957.64 | 4,040.62 | 5,520.46 |

| In vivo CAR T therapy (emerging) | 188.57 | 292.24 | 448.06 | 680.83 | 1,026.89 |

| Off-the-shelf / Ready-to-use therapies | 352.42 | 483.67 | 664.10 | 912.00 | 1,252.69 |

CAR T-Cell Therapy Market Size, by End Use, 2022 to 2026 (USD Million)

| Region | 2022 | 2023 | 2024 | 2025 | 2026 |

| Hospitals | 1,327.56 | 1,800.55 | 2,442.28 | 3,312.06 | 4,490.58 |

| Cancer Treatment Centers | 846.27 | 1,176.53 | 1,636.55 | 2,277.05 | 3,169.07 |

| Academic & Research Institutes | 372.47 | 506.51 | 688.94 | 936.98 | 1,274.19 |

| Specialty Clinics | 162.67 | 249.04 | 378.03 | 569.65 | 853.17 |

| Contract Development and Manufacturing Organizations (CDMOs) | 161.00 | 243.37 | 365.53 | 545.88 | 811.28 |

Kindly use the following link to access our scheduled meeting@ https://www.statifacts.com/schedule-meeting

What is CAR T-Cell Therapy?

The CAR T-cell therapy market refers to the production, distribution, and use of CAR T-cell therapy, which is a cancer treatment that takes cells from the body and genetically changes them so they can fight cancer. It is most commonly used to treat cancers that affect blood cells, like specific types of leukemia, lymphoma, and multiple myeloma. CAR T-cell therapy is available for some children and adults with leukemia. The CARs help the cells to latch on to specific proteins, known as antigens, that are present on cancer cells.

CAR T-cells can cure specific types of blood cancer. The benefit of CAR T-cell therapy is the short treatment time required for completion. It scores over the other traditional cancer treatments in long-term remission with a better quality of life for the patient. CAR T-cell therapy modifies a patient's T-cells to target and destroy cancer cells.

Major Government Initiatives in CAR T-Cell Therapies:

- France 2030 – Universal CAR-T Grant to Allogenica: Under the French government’s Innovations in Biotherapies and Bioproduction component of the France 2030 program, Allogenica was awarded a €2.5 million grant to industrialize a universal (allogeneic) CAR-T platform. This aims to boost scalability, reduce costs, and strengthen France’s domestic biomanufacturing ecosystem for CAR-T therapies.

- The Netherlands’ “CAR-TB-CURE” Clinical Study for Autoimmune Diseases: The Dutch National Healthcare Institute and the research council (ZonMw) are funding (~€14.6 million) a six-year project spearheaded by Leiden University Medical Center and Amsterdam UMC to investigate CAR-T therapy for severe autoimmune diseases. The “CAR-TB-CURE” initiative also aims to address issues of safety, cost-effectiveness, and accessibility evaluating whether academic/hospital-produced CAR-T can be part of standard care.

- Germany: BMBF Funding for New CAR-T Targets (CXCR5) in Lymphoma: Germany’s Federal Ministry of Education and Research (BMBF) is funding (€4.6 million) a joint project by Charité and the Max Delbrück Center to push a novel CAR-T target (CXCR5) into human trials for B-non-Hodgkin’s lymphoma. This helps stimulate early-stage innovation in antigen discovery and preclinical/clinical translation.

- England / NHS Expansion of CAR-T Access via Cancer Drugs Fund: NHS England has struck new funding and policy deals allowing personalized CAR-T treatments (e.g., axicabtagene ciloleucel, etc.) to be made more widely available for eligible patients through the Cancer Drugs Fund (CDF). This increases patient access by enabling reimbursement and setting protocols for broader eligibility in certain blood cancers.

-

EU / European Innovation Council (EIC) Support for Clinical Trials: Through EU-level funding mechanisms (like the European Innovation Council’s Accelerator programme), governments are financing CAR-T clinical trials to de-risk early development. An example is Elicera Therapeutics getting €2.5 million from EIC to fully fund its phase I/II trial (ELC-301) for treating B-cell lymphoma.

What are the Key Trends of the CAR T-Cell Therapy Market?

- Expansion into Solid Tumors: While CAR T-cell therapies have shown strong success in blood cancers, researchers are now applying them to solid tumors like glioblastoma and lung cancer. Overcoming tumor microenvironments and antigen heterogeneity is a major focus of ongoing clinical trials.

- Development of Allogeneic (Off-the-Shelf) Therapies: Allogeneic CAR-T uses donor cells, offering faster treatment and lower costs compared to patient-specific (autologous) therapies. This approach enables mass production and addresses limitations like manufacturing delays and variability.

- Advancements in Manufacturing Technologies: Automation, AI, and closed-system manufacturing are streamlining CAR-T production, improving consistency and scalability. These innovations are reducing costs and turnaround times, which are critical for broader market adoption.

- Earlier-Line Treatment Approvals: Regulatory bodies are approving CAR-T therapies for use earlier in the treatment journey, such as second-line settings. This shift significantly expands the eligible patient population and increases commercial potential.

-

Global Market Expansion and Regional Innovation: The CAR-T market is rapidly growing in the Asia-Pacific regions, with China and South Korea emerging as innovation hubs. Local companies and favorable regulatory environments are accelerating development and access to therapies.

Case Study: Gilead Sciences & Arcellx – Redefining CAR T-Cell Therapy Through Next-Generation BCMA Innovation

CAR T-cell therapy, once an experimental treatment for rare blood cancers, has rapidly evolved into one of the most promising frontiers in oncology. Among the therapeutic targets, B-cell maturation antigen (BCMA) has emerged as a crucial focus for addressing relapsed or refractory multiple myeloma (RRMM). This market segment is witnessing exceptional growth, projected to register a CAGR of over 46% from 2025 to 2034, driven by novel therapies demonstrating improved efficacy, scalability, and patient outcomes.

In this context, Gilead Sciences (via its Kite Pharma subsidiary) and Arcellx Inc. have formed one of the most strategically impactful alliances in the CAR-T ecosystem. Their lead investigational product, anito-cel (formerly known as CART-ddBCMA), represents a new generation of CAR T-cell therapy targeting BCMA with enhanced safety and durability of response.

Challenge:

Despite remarkable success in hematologic malignancies, CAR T-cell therapies have faced three key limitations:

- Safety risks such as cytokine release syndrome (CRS) and neurotoxicity.

- Manufacturing delays associated with autologous CAR T production, leading to treatment bottlenecks.

-

Short duration of remission, especially in patients with advanced or refractory myeloma.

Patients who relapse after prior CAR-T treatments often have limited options, creating a clinical and commercial need for safer, longer-lasting, and more scalable CAR T-cell products.

Solution:

Arcellx’s proprietary ARC-SparX platform introduced a modular CAR design that allows precise activation of engineered T cells only in the presence of a matching antigen-binding “SparX” protein. This innovation provides:

- Improved safety control (reduces off-tumor toxicity and cytokine storms).

- Flexible reactivation (enables re-dosing for sustained therapeutic effects).

-

Simplified manufacturing with enhanced cell viability.

Gilead Sciences, leveraging its commercial and regulatory infrastructure, partnered with Arcellx in December 2022, investing over USD 225 million upfront and later expanding the deal to USD 1.25 billion to co-develop and co-commercialize anito-cel globally.

Implementation:

The collaboration moved rapidly through the clinical development phase.

- In November 2024, Gilead and Arcellx presented updated Phase 2 trial data at the American Society of Hematology (ASH) Annual Meeting.

- 95% overall response rate (ORR) and 62% complete or stringent complete response (CR/sCR) were reported among 58 patients with RRMM.

- Median follow-up: 10.3 months.

- Safety profile: No delayed neurotoxicity, reduced cytokine release incidents compared to earlier CAR T versions.

Manufacturing efficiency also improved, with turnaround times reduced by nearly 30%, enhancing patient access.

Results:

| Key Metrics | Anito-cel (Arcellx + Gilead) | Industry Benchmark (Average) | |

| Overall Response Rate (ORR) | 95 | % | 70–80% |

| Complete Response (CR/sCR) | 62 | % | 35–45% |

| Median Duration of Response | >12 months (projected) | 8–10 months | |

| Severe CRS Incidence | <5% | 10–20% | |

| Time-to-Treatment | Reduced by 30% | Standard autologous timeframe | |

These outcomes place anito-cel among the most promising next-generation CAR T therapies in development. Analysts from Fierce Biotech and Evaluate Vantage noted that the therapy could “outperform Carvykti” (Johnson & Johnson/Legend Biotech) in long-term safety and consistency.

Impact:

-

Clinical Impact:

The partnership established a model for collaborative innovation between a global biopharma leader and a specialized CAR T developer. The therapy’s performance reinforces the viability of BCMA as a target antigen and demonstrates how modular CAR designs can mitigate toxicity risks. -

Market Impact:

The case has shifted investor focus toward second-generation CAR platforms, accelerating funding for companies working on tunable and allogeneic CARs. It directly supports Statifacts’ market projection of the BCMA segment’s 46% CAGR and validates the trend of next-gen cell therapy scaling. -

Regulatory & Commercial Outlook:

Gilead is expected to file for FDA submission in late 2025, with EU and APAC filings following soon after. This expansion could reshape market competition and pricing dynamics, creating pressure on legacy products like Kymriah and Abecma.

Key Takeaways:

-

Strategic Partnerships Accelerate Innovation:

Collaborations between niche innovators (Arcellx) and established players (Gilead) can bridge technical and regulatory gaps in complex biologics. -

BCMA Target Validity Strengthened:

Consistent efficacy across trials reinforces BCMA as a long-term growth engine in the CAR T landscape. -

Patient Accessibility & Manufacturing Optimization Are Core Growth Drivers:

The focus has shifted from “curing cancer” in isolated cases to scaling therapies efficiently for real-world application.

Customize This Study as Per Your Requirement@ https://www.statifacts.com/stats/customization/8510

CAR T-Cell Therapy Market Dynamics

Market Driver

-

Growing demand for personalized cancer treatments:

The personalized cancer treatment goal is to improve tumor response while minimizing therapy side effects, resulting in improved patient care and quality of life. Personalized medicines help to improve patient outcomes by providing more effective treatments and reducing the risk of side effects associated with chemotherapy and other traditional cancer treatments. This may lead to reduced costs associated with hospital stays and other medical procedures. Personalized medicine uses detailed information about a person’s cancer to improve treatment.

Market Restraint

-

Side effects of CAR T-cell therapy:

The most common side effect of CAR T-cell therapy is called cytokine release syndrome or CRS. It can affect up to 9 in 10 CAR T-cell patients. CAR T-cell therapies are associated with unique adverse events (AEs), including cytokine release syndrome (CRS) and neurologic events. It also includes side effects like low blood counts, infection risk, low B-cell count, allergic reactions, and tumor lysis treatment. Infection risk includes symptoms like generally feeling unwell, tummy pain, being sick, discharge coming from it, redness or pain around the central line, extreme tiredness, feeling breathless, a cough or chest, shivering, or a high temperature.

Market Opportunity

-

Advancement in biotechnology and genetic engineering:

Some benefits of advancement in biotechnology and genetic engineering in agriculture include greater food security, resistance to pests and diseases, enhanced nutrient composition and food quality, reduced need for pesticides, reduced costs for food or drug production, and increased crop yields. Biotechnology is the use of biology to solve problems and make useful products. The most prominent approach used is genetic engineering, which allows scientists to tailor an organism’s DNA at will. Genetic engineering is a faster and more efficient way of getting the same results as selective breeding. Improving crop quality or crop yields, which is important in developing countries, may help to reduce hunger around the world.

Ready to Dive Deeper? Visit Here to Buy Databook & In-depth Report Now@ https://www.statifacts.com/order-databook/8510

CAR T-Cell Therapy Market Scope

| Report Attribute | Key Statistics | |

| Market Size in 2024 | USD 5.51 Billion | |

| Market Size in 2025 | USD 7.64 Billion | |

| Market Size in 2031 | USD 54.61 Billion | |

| Market Size by 2034 | USD 146.55 Billion | |

| CAGR 2025-2034 | 38.83% | |

| Leading Region in 2024 | North America | |

| Fastest Growing Region | Asia Pacific | |

| Base Year | 2024 | |

| Historical Year | 2021 - 2023 | |

| Forecast Period | 2025 to 2034 | |

| Quantitative units | Revenue in USD million and CAGR from 2025 to 2034 | |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends | |

| Segments Covered | By Target Antigen, By Indication / Disease Type, By Type of Therapy, By Technology / Vector Used, By Manufacturing/Delivery Method, By End User, and By Region | |

| Regional analysis | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

| Leading Players | Johnson & Johnson Services Inc., ALLOGENE THERAPEUTICS, Lonza, Aurora Biopharma, Cartesian Therapeutics Inc., Novartis, Bristol-Myers Squibb company, Gilead Sciences, Curocell Inc, JW Therapeutics, and Others. | |

Kindly use the following link to access our scheduled meeting@ https://www.statifacts.com/schedule-meeting

CAR T-Cell Therapy Market Segmentation

Target Antigen Insights

How CD19 Segment Leads the CAR T-Cell Therapy Market?

The CD19 segment led the market in 2024. CD19 CAR T cell therapy enhances the treatment of autoimmune diseases by inducing lasting, drug-free remission and provides a roadmap for the development of therapies specific to autoimmune diseases. CD19 is the major stimulatory co-receptor of B-cells. It is required for the development of subsets of B cells and for the response of mature B cells to both TI-2 and TD antigens. CD19 is consistently and broadly expressed on the surface of most malignant B-cells in diseases like acute lymphoblastic leukemia (ALL), diffuse large B-cell lymphoma (DLBCL), chronic lymphocytic leukemia (CLL), and follicular lymphoma. This makes it a reliable and accessible target for CAR T-cell therapies.

The BCMA (B-cell Maturation Antigen) segment is expected to grow at a significant CAGR over the projected period. B-cell maturation antigen (BCMA) is one of the promising targets for immunotherapy in the management of relapsed/refractory multiple myeloma. Engagement of T-cells to malignant cells expressing B-cell maturation antigen (BCMA) leads to selective, redirected lysis of MM cells. BCMA, by its ligand, increases survival and long-lived plasma cells that contribute to MM development.

Indication/Disease Type Insights

How Hematologic Malignancies Dominated the CAR T-Cell Therapy Market?

The hematologic malignancies segment dominated the market in 2024. CAR-T cell therapy represents a major breakthrough in cancer treatment, and it has achieved unprecedented success in hematological malignancies. CAR T-cell has become a powerful treatment option in B-cell and plasma cell malignancies, and many patients have benefited from its use. The CAR-T cell therapy has been used predominantly in the treatment of hematological malignancies, including lymphoma, chronic lymphocytic leukemia, acute lymphoblastic leukemia, and multiple myeloma.

The solid tumors segment is anticipated to grow at a significant CAGR from 2025 to 2034. To improve CAR-T cell efficacy in solid tumors, we explore strategies like improving T cell persistence and cytotoxicity, targeting multiple antigens, and using innovative allogenic CAR-T cell manufacturing. The therapeutic benefit of CAR-T cell therapy observed in hematological malignancies has not been translated into solid cancers.

Technology/Vector Used Insights

How Viral Vectors Segment Dominated the CAR T-Cell Therapy Market?

The viral vectors segment dominated the market in 2024, due to its proven clinical efficacy, high gene transfer efficiency, and durable CAR expression, all of which are critical for successful treatment outcomes. All currently approved CAR T-cell therapies rely on lentiviral or retroviral vectors, benefiting from well-established manufacturing infrastructure and regulatory familiarity. These vectors enable stable integration of the CAR gene into T cells, ensuring long-term therapeutic effects, especially in hematologic cancers. Despite emerging alternatives like non-viral delivery and gene editing, challenges such as transient expression and scalability issues keep viral vectors as the preferred choice.

The dual and multiple antigen targeting CAR T-cell segment is expected to grow fastest over the forecast period, driven by their ability to address several key limitations of single-antigen CARs. These include reducing relapse from antigen escape (when a tumor loses or downregulates the target antigen), improving recognition of heterogeneous tumor cell populations, and enhancing specificity to reduce off-tumor toxicity. The heightened therapeutic potential makes them more attractive in both hematologic malignancies and solid tumors, especially when single-antigen approaches have failed or have limited durability.

Manufacturing/Delivery Method

Which Manufacturing/Delivery Method Leads the CAR T-Cell Therapy Market?

The centralized manufacturing segment led the market in 2024. CAR T-cell therapy is delivered systematically and intravenously. Central line insertion of a catheter. This is the most common method of infusion of CAR-T cells to systemic circulation after ex vivo manufacturing. This is the classic method of CAR-T cells administration to cancers within the human body is through intravenous (IV) central line infusion. Centralized manufacturing, where patient cells are collected at clinics or hospitals and shipped to a central GMP facility for processing, vector transduction, quality assurance, and then shipped back, offers economies of scale, tighter quality control, and regulatory alignment that make it the default model for commercial CAR T products.

The in vivo CAR T cell therapy segment is expected to grow at the fastest CAGR over the projected period. In vivo CAR T cell therapy has the benefit of both CAR T cell therapy and antibody drugs, which show rapid and constant anti-cancer efficacy and are suitable for patients with rapidly progressive diseases. In vivo CAR-T gene therapies can overcome the challenges faced by autologous and allogeneic treatments. During in vivo exposure, patients engage in activities where they gradually approach trauma-related memories, feelings, and situations that are avoided because of the trauma.

End User Insights

What Made the Hospitals Dominate the CAR T-Cell Therapy Market?

The hospitals segment dominated the market share in 2024. One of the main benefits of CAR T cell therapy is the short treatment time needed, administered with a single infusion that may need at most two weeks of inpatient care, and then it’s done. During the CAR T-cell therapy, we will receive the full course of treatment on an outpatient basis rather than being admitted to the hospital for 10 to 14 days. Administering CAR T therapy requires specialized infrastructure, including cell collection (apheresis) units, cryopreservation equipment, and intensive care capabilities to manage potentially life-threatening side effects like cytokine release syndrome (CRS) and neurotoxicity. In addition, hospitals must have trained multidisciplinary teams, including hematologists, immunologists, and ICU staff, along with the necessary accreditations (such as FACT certification) to deliver CAR T therapies safely and in compliance with regulatory standards.

- According to a report, Mayo Clinic has been one of the top cancer centers in the country for many years. In the United States, Mayo Clinic is also consistently rated the top hospital. They specialize in and offer all the available CAR T cell therapies, and also have many clinical trials and CAR T-cell treatment. Source: Mayo Clinic

The contract development and manufacturing organization (CDMO) segment is expected to grow at a significant CAGR from 2025 to 2034. The benefits of collaborating with a cell therapy CDMO include scalability, speed to market, access to technical expertise without cost efficiencies, and overhead costs. Companies are signing supply agreements with CDMOs, building internal manufacturing capabilities, and enhancing manufacturing processes and efficiency by exploring new technologies. Cell therapy CDMO provides analytical and process development expertise to improve and scale up CAR-T cell manufacturing, supporting at every stage.

Regional Insights

North America CAR T-Cell Therapy Market

North America dominated the global market in 2024 due to the robust product pipeline with regulatory approvals, increasing shift towards targeted treatments, rising cases of cancer malignancies across the population, improved in-hospital infrastructure, strong clinical pipeline, suitable reimbursement, regulatory approvals, rising demand for personalized medicine, and expanding applications in the region. The growing prevalence of cancer and strong investments in R&D are contributing to this growth. The strong presence of strict regulations and their approvals for novel therapies is fueling this growth.

The U.S. dominates the regional market due to its robust biopharmaceutical ecosystem, extensive R&D investments, and strong regulatory support that accelerate innovation and commercialization. It houses leading biotech companies, top-tier research institutions, and advanced manufacturing infrastructure, enabling rapid development and scaling of CAR T therapies. Additionally, the U.S. Food and Drug Administration’s (FDA) proactive and clear regulatory pathways have facilitated faster approvals of CAR T products compared to other countries. The presence of numerous clinical trial sites and a large patient population further supports market growth by enabling extensive testing and adoption of these therapies.

Asia Pacific CAR T-Cell Therapy Market

Asia Pacific is expected to grow at the fastest CAGR during the forecast period because of the increased R&D investments, technological innovations, increasing cancer incidences, growing demand for effective cancer treatments, growing cancer prevalence, increasing senior population, growing prevalence of rate of many diseases, including lymphoma and multiple myeloma, and heightened awareness of treatment options. The strong government & regulatory support for the pharmaceutical industry and R&D are fueling innovations and developments of comprehensive CAR T-cell Therapies. The market is further seeking growth with factors like increasing investments in genetic engineering and demand for personalized medicines.

Country-Level Investments & Funding for CAR T-Cell Therapy Industry:

- United States - The U.S. has been a pioneer in CAR T-cell therapy development, with substantial investments from both government agencies like the National Institutes of Health (NIH) and private companies. The FDA has approved several CAR T therapies, and the U.S. market continues to lead in both clinical trials and commercial applications.

- China - China has invested heavily in CAR T-cell therapy, with over $2.37 billion allocated in 2021 to support research and development. The country now surpasses the U.S. in the number of CAR T therapy clinical trials registered, focusing extensively on the CD19 target.

- Japan - Japan's government has committed approximately $260 million over four years to support capital investment and human resource development for contract development and manufacturing organizations (CDMOs) of regenerative medicine products, including CAR T-cell therapies.

- France - Allogenica received a €2.5 million grant from the French government's France 2030 program to support the industrialization of its universal CAR-T therapies for blood cancers. This funding aims to reduce production costs and enhance treatment availability.

-

Sweden - Elicera Therapeutics was awarded €2.5 million in funding from the European Innovation Council (EIC) Accelerator Programme to finance a clinical Phase I/II trial of its CAR T-cell therapy, ELC-301, for B-cell lymphoma.

Browse More Research Reports:

- The US cell therapy market size was calculated at USD 4.24 billion in 2024 and is predicted to attain around USD 21.41 billion by 2034, expanding at a CAGR of 17.57% from 2025 to 2034.

- The global automated and closed cell therapy processing system market size surpassed USD 1,530 million in 2024 and is predicted to reach around USD 12,630 million by 2034, registering a CAGR of 23.5% from 2025 to 2034.

- The global autologous cell therapy market size was evaluated at USD 5,430 million in 2024 and is expected to grow around USD 40,020 million by 2034, registering a CAGR of 22.11% from 2025 to 2034.

- The global cell therapy raw materials market size was evaluated at USD 4,690 million in 2024 and is expected to grow around USD 24,970 million by 2034, registering a CAGR of 18.2% from 2025 to 2034.

- The global stem cell therapy market size was evaluated at USD 16.04 billion in 2024 and is expected to grow around USD 54.45 billion by 2034, registering a CAGR of 13% from 2025 to 2034.

- The global cell therapy technologies market size was estimated at USD 6,560 million in 2024 and is projected to be worth around USD 34,040 million by 2034, growing at a CAGR of 17.9% from 2025 to 2034.

- The global cell therapy growth factor market size accounted for USD 668 million in 2024 and is expected to exceed around USD 1,389.63 million by 2034, growing at a CAGR of 7.6% from 2024 to 2034.

- The global cell therapy manufacturing market size is predicted to gain around USD 15,753 million by 2034 from USD 4,139 million in 2024 with a CAGR of 14.3%.

Ready to Dive Deeper? Visit Here to Buy Databook & In-depth Report Now@ https://www.statifacts.com/order-databook/8510

Top Companies in CAR T-Cell Therapy Market

- JW Therapeutics - JW Therapeutics focuses on developing, manufacturing, and commercializing innovative CAR-T cell therapies in China, including its lead product relma-cel targeting CD19 for B-cell malignancies.

- Curocell Inc. - Curocell Inc. is advancing next-generation CAR-T cell therapies designed to overcome tumor microenvironment resistance, with its lead candidate CRC01 currently in clinical trials for relapsed or refractory B-cell lymphoma.

- Gilead Sciences - Gilead Sciences, through its Kite Pharma subsidiary, offers FDA-approved CAR-T therapies such as Yescarta and Tecartus for various hematologic cancers, focusing on rapid manufacturing and global access.

- Bristol-Myers Squibb Company - Bristol-Myers Squibb markets Breyanzi and Abecma, two CAR-T therapies targeting CD19 and BCMA, respectively, and continues to expand its pipeline in both hematologic and solid tumors.

- Novartis - Novartis was the first to bring a CAR-T therapy to market with Kymriah, approved for pediatric and young adult acute lymphoblastic leukemia and adult diffuse large B-cell lymphoma, and is actively researching next-gen CAR platforms.

- Cartesian Therapeutics, Inc. - Cartesian Therapeutics develops RNA-engineered cell therapies, including Descartes-11, a CAR-T product designed for autoimmune diseases and cancers with transient, non-viral CAR expression to improve safety.

- Aurora Biopharma - Aurora Biopharma is focused on CAR-T therapies for solid tumors, developing novel CAR constructs that target tumor-associated antigens like HER2 in cancers such as glioblastoma and pancreatic cancer.

- Lonza - Lonza is a leading global contract manufacturer offering end-to-end CAR-T cell therapy development and manufacturing services, supporting biotech and pharma companies with scalable and GMP-compliant production solutions.

- ALLOGENE THERAPEUTICS - Allogene Therapeutics is pioneering allogeneic (off-the-shelf) CAR-T therapies using gene editing technologies to eliminate the need for patient-specific cell collection, with multiple programs in clinical development.

- Johnson & Johnson Services, Inc. - Johnson & Johnson, through its Janssen division, is advancing CAR-T therapies, including Carvykti, a BCMA-directed treatment for multiple myeloma developed in partnership with Legend Biotech.

Recent Developments

- In January 2025, Qartemi, a global CAR T-cell therapy for adult B-cell Non-Hodgkin Lymphoma (B-NHL), was launched by Immuneel Therapeutics. This new therapy aims to address a critical gap in India’s cancer immunotherapy landscape. Source: Express Pharma

- In April 2025, the opening of South India’s premier Centre of Excellence in CAR T-cell Therapy and Bone Marrow Transplantation at Smita Memorial Hospital in Thodupuzha, Idukki district, Kerala was announced by SunAct Cancer Institute and Smita Memorial Hospital. This partnership, formalized in March 2025, represents a significant stride in offering cost-effective, globally benchmarked cell and gene therapies to India, with a strong emphasis on pediatric care, precision oncology, and access to global clinical trials. Source: Healthcare Radius

Segments Covered in the Report

By Target Antigen

- CD19

- BCMA (B-cell Maturation Antigen)

- CD22

- GD2

- HER2

- GPC3

- Others (e.g., EGFRvIII, CD7, CD123, mesothelin)

By Indication / Disease Type

- Hematologic Malignancies

- Acute Lymphoblastic Leukemia (ALL)

- Diffuse Large B-cell Lymphoma (DLBCL)

- Mantle Cell Lymphoma (MCL)

- Follicular Lymphoma (FL)

- Multiple Myeloma (MM)

- Chronic Lymphocytic Leukemia (CLL)

- Hodgkin’s Lymphoma

- Other Non-Hodgkin Lymphomas (NHL)

- Solid Tumors

- Neuroblastoma

- Glioblastoma

- Breast Cancer

- Pancreatic Cancer

- Ovarian Cancer

- Lung Cancer

- Prostate Cancer

- Colorectal Cancer

- Others

By Type of Therapy

- Autologous CAR T-cell Therapy

- Allogeneic CAR T-cell Therapy

By Technology / Vector Used

- Viral Vectors

- Lentiviral vectors

- Retroviral vectors

- Non-viral Vectors

- CRISPR/Cas9 gene editing

- Transposons (Sleeping Beauty, PiggyBac)

- mRNA electroporation

- Armored CAR T-Cells (enhanced T-cell persistence/activity)

- Dual/Multiple Antigen Targeting CAR T-Cells

- Safety Switch-Equipped CAR T Cells

By Manufacturing/Delivery Method

- Point-of-Care Manufacturing

- Centralized Manufacturing

- In vivo CAR T therapy (emerging)

- Off-the-shelf / Ready-to-use therapies

By End User

- Hospitals

- Cancer Treatment Centers

- Academic & Research Institutes

- Specialty Clinics

- Contract Development and Manufacturing Organization

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

You can place an order or ask any questions, please feel free to contact us at sales@statifacts.com

Statifacts offers subscription services for data and analytics insights. This page provides options to explore and purchase a subscription tailored to your needs, granting access to valuable statistical resources and tools. Access here - https://www.statifacts.com/get-a-subscription

Contact US

- Ballindamm 22, 20095 Hamburg, Germany

- Web: https://www.statifacts.com/

-

Europe: +44 7383 092 044

About US

Statifacts is a leading provider of comprehensive market research and analytics services, offering over 1,000,000 market and custoer data sets across various industries. Their platform enables businesses to make informed strategic decisions by providing full access to statistics, downloadable in formats such as XLS, PDF, and PNG.

Our Trusted Data Partners:

Precedence Research | Towards Healthcare | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Nova One Advisor

Explore More Reports:

- Vitamin D Market - https://www.statifacts.com/outlook/vitamin-d-market

- Bamboo Flooring Market - https://www.statifacts.com/outlook/bamboo-flooring-market

- Spine Biologics Market - https://www.statifacts.com/outlook/spine-biologics-market

- Membrane Oxygenator Market - https://www.statifacts.com/outlook/membrane-oxygenator-market

- Hydrazine Hydrate Market - https://www.statifacts.com/outlook/hydrazine-hydrate-market

- Chelants Market - https://www.statifacts.com/outlook/chelants-market

- Cricket Equipment Market - https://www.statifacts.com/outlook/cricket-equipment-market

- Wafer-Level Vacuum Laminator Market - https://www.statifacts.com/outlook/wafer-level-vacuum-laminator-market

-

Quantum Encryption Communication Modules Market - https://www.statifacts.com/outlook/quantum-encryption-communication-modules-market

- Automotive Copper Core Cable Market - https://www.statifacts.com/outlook/automotive-copper-core-cable-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.