Green Polypropylene Market Size | Companies Analysis 2025- 2034

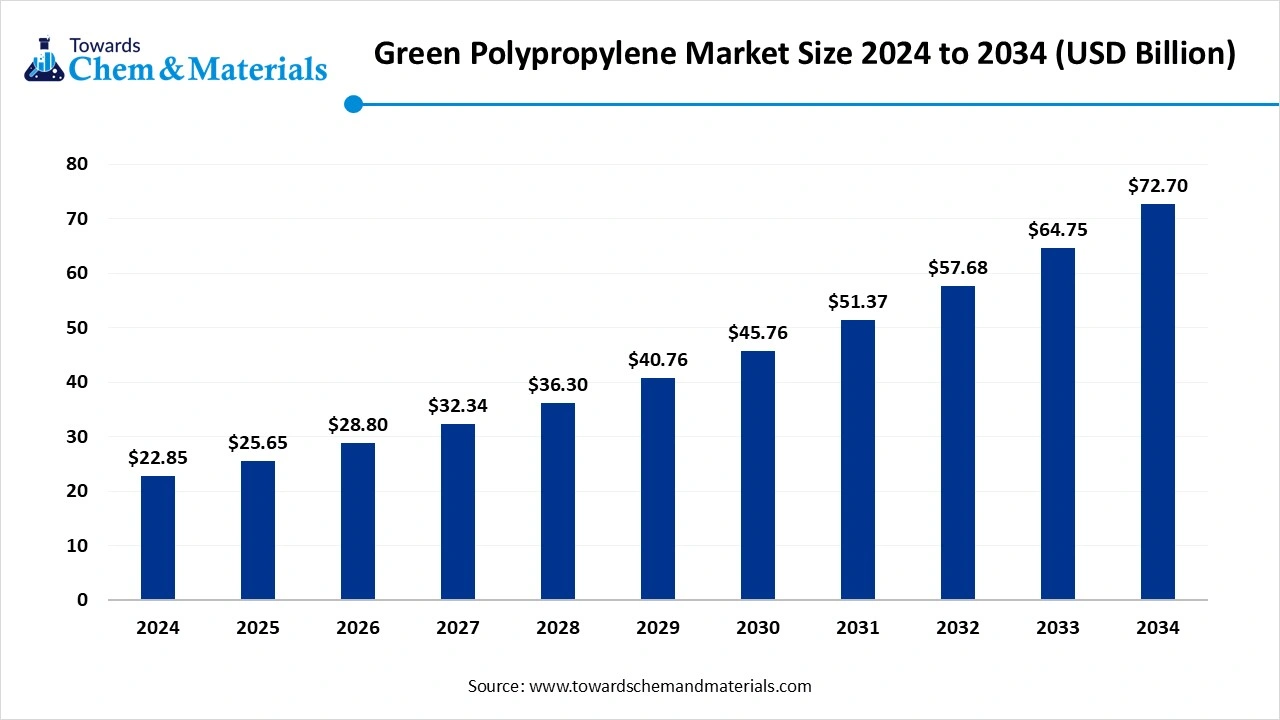

According to Towards Chemical and Materials, the global Green Polypropylene market size is calculated at USD 25.65 billion in 2025 and is expected to be worth around USD 72.70 billion by 2034, growing at a compound annual growth rate (CAGR) of 12.27% over the forecast period 2025 to 2034. The key market players identified in the report are BASF SE (DE), LyondellBasell Industries N.V. (NL), Braskem S.A. (BR), Mitsui Chemicals, Inc. (JP), SABIC (SA), TotalEnergies SE (FR), ExxonMobil Chemical Company (US), Repsol S.A. (ES), PolyOne Corporation (US)

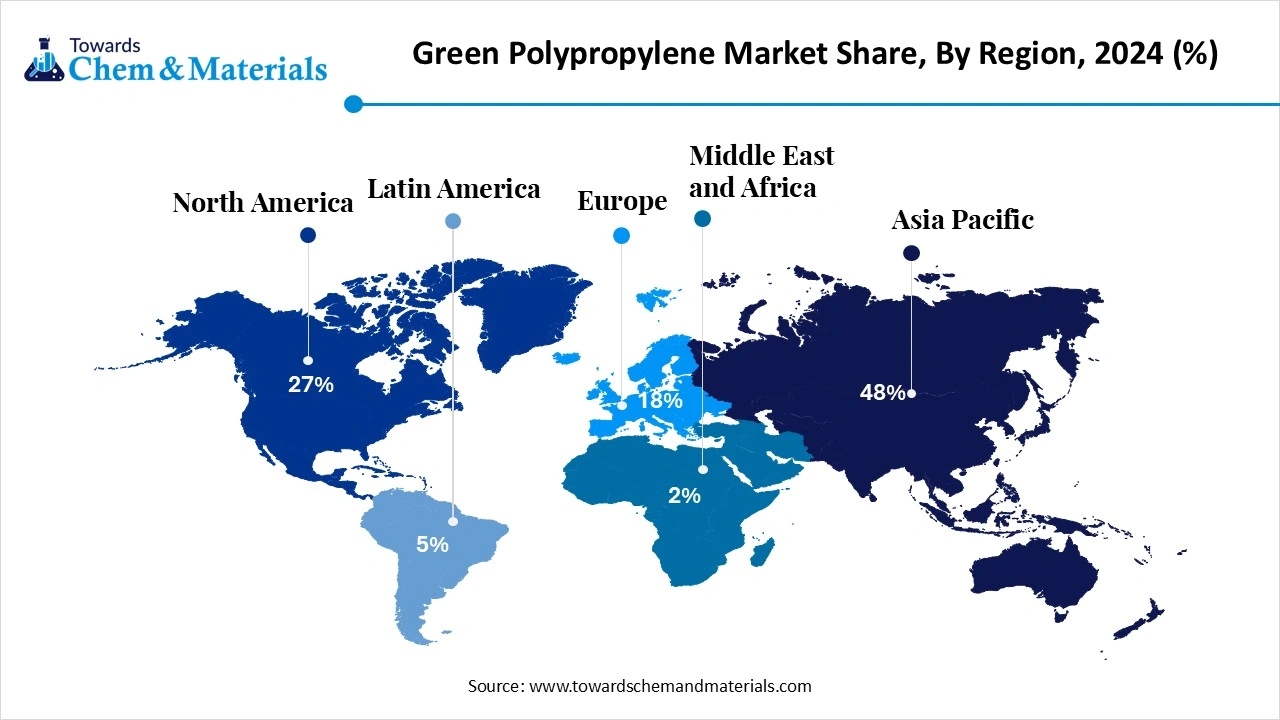

Ottawa, Oct. 30, 2025 (GLOBE NEWSWIRE) -- The global green polypropylene market size was valued at USD 22.85 billion in 2024 and is anticipated to reach around USD 72.70 billion by 2034, growing at a compound annual growth rate (CAGR) of 12.27% over the forecast period from 2025 to 2034. Asia Pacific dominated the Green Polypropylene market with a market share of 48% in 2024. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5941

Green Polypropylene Overview

The market for green polypropylene is evolving rapidly as manufacturers, brand owners and end-users increasingly prioritise lower-carbon, recycled and bio-based alternatives to conventional polypropylene, driven by regulatory pressure, consumer led sustainability preferences and the rising availability of renewable feedstocks and chemical recycling technologies. In essence, green polypropylene refers to polypropylene produced with a materially lower cradle-o-gate greenhouse gas footprint than traditional PP, encompassing bio-based polypropylene, mass balance certified material, mechanically recycled polypropylene and low carbon routes such as e-/power to chemistry or carbon capture enabled processes. The value chain spans feedstock supplier, polymer producers, compounders and recyclers, all of whom navigating challenges around constrains and cost competitiveness. At the same time, the market is benefiting from the string growth of end use industries such as packaging, automotive, consumer goods and technical applications that seek lightweight, durable, easily recyclable materials.

Green Polypropylene Market Report Highlights

- By region, Asia Pacific dominated the green polypropylene market with 48% industry share in 2024.

- By feedstock type, the mechanical recycled PP segment dominated the market with 40% industry share in 2024.

- By product grade type, the homopolymer green PP segment dominated the market with 55% industry share in 2024.

- By application type, the packaging segment dominated the market with 50% industry share in 2024.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5941

Green Polypropylene Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 28.80 billion |

| Revenue forecast in 2030 | USD 72.70 billion |

| Growth rate | CAGR of 12.27% from 2025 to 2034 |

| Base year for estimation | 2025 |

| Historical data | 2021 - 2025 |

| Forecast period | 2025 - 2035 |

| Quantitative units | Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2034 |

| Report coverage | Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

| Segments covered | By Feedstock / Source, By Product Grade, By Application, By Region |

| Regional scope | North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

| Country Scope | U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; Brazil; Argentina; GCC Countries; South Africa |

| Key companies profiled | BASF SE (DE), LyondellBasell Industries N.V. (NL), Braskem S.A. (BR), Mitsui Chemicals, Inc. (JP), SABIC (SA), TotalEnergies SE (FR), ExxonMobil Chemical Company (US), Repsol S.A. (ES), PolyOne Corporation (US) |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Here Are Some Of The Top Products In The Green Polypropylene Market

- Green PP Plastic Granules – Industrial Grade: Industrial-grade recycled PP granules suited for injection or extrusion, designed for general goods from post-industrial/consumer waste.

- Super Green PP Granules – Recycled Grade: A recycled PP granule offering with enhanced density (~0.90-0.92 g/cm³) and typical performance for sustainable manufacturing.

- Eco-Friendly Polypropylene PP Packaging Bags: Transparent PP packaging bags labelled “eco-friendly”, using PP copolymer (likely recycled or low-carbon feedstock) for general storage/packing.

- Green PP Attached-Lid Container (600×400×400mm): A sizable container made in green-coloured PP material (likely recycled or with sustainable claim) for industrial or warehousing use.

- Eco-Friendly PP Flexible Material – Non-Toxic PP Bag: Flexible consumer-grade PP bag material marketed as eco-friendly/non-toxic, implying sustainable PP grade.

- Polypropylene Sheet Stock – Recycled Content PP Sheet: Sheet stock of polypropylene used for fabrication, signage, or parts — offers recycled content or sustainable PP variant.

- Green PP Roofing Sheet: Roofing sheet made from PP (green coloured) aimed at construction/industrial uses, representing adoption of sustainable PP in building materials.

- Greenworks PP Chopping Board: A consumer goods item (chopping board) made from PP — marketed as environmentally friendly, showing PP’s circular usage in household items.

- Reinforced Green Tarpaulin – PP Base: A tarpaulin using a PP base material (reinforced) and green colour, demonstrating PP’s use in heavy-duty outdoor goods from green/sustainable grade.

- PP Webbing Strap – Polypropylene Green Webbing: A utility strap or webbing made from PP with “green” descriptor — showing PP’s role even in textile/utility goods adopting recycled or eco PP.

What Are The Major Trends In The Green Polypropylene Market ?

- Growing emphasis on circular economy and recycling technologies, with manufacturers increasingly adopting mechanical and chemical recycling routes for polypropylene.

- Strong regulatory and sustainability pressure pushing brand owners and converts to transition from fossil based polypropylene to low carbon, renewable based or mass balance certifies polypropylene.

- Technological innovation gaining traction including bio catalytic polymerisation, CO2- to polymer conversion, and investment in advanced bio-refinery and chemical recycling infrastructure.

- Shifting end use demand driven by packaging, automotive and consumer goods sectors favouring lightweight, recyclable materials, which is fuelling uptake of green polypropylene across these application.

How Does AI Influence The Growth Of The Green Polypropylene Market In 2025?

AI is helping to drive growth in the green polypropylene market in 2025. By allowing manufacturers to make their production processes more efficient, cut down on waste, and use resources better. This is done through machine learning models that study how different raw materials behave. Predictive maintenance systems that keep plants running smoothly, and digital twin that test polymerization paths using lower carbon materials. Additionally, AI powered analytics help ensure transparency and traceability in the supply chain, showing where renewable or recycled materials come from. This assists products and brand owners in proving their sustainability efforts and meeting tougher environmental rules. Meanwhile, AI speeds up the development of new catalysts, reactor designs, and material formula by analysing big sets of chemical data to find better polymers structures and production methods. This reduces costs and makes eco-friendly polypropylene more affordable and practical for wider use.

Invest in Premium Global Insights Immediate Delivery Available (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5941

Green Polypropylene Market Dynamics

Growth Factors

Can Advanced Recycling Reshape Polypropylene’s Future?

New Chemical and mechanical recycling methods are turning polypropylene into high quality feedstock, reducing dependence on virgin materials and cutting emissions. These advanced make green polypropylene more scalable and attractive for circular manufacturing.

Will Smarter Design Boost Green Polypropylene Demand?

Design for recycling standards are making polypropylene products easier recover and reuse, driving manufacturers toward greener material choices and strengthening circular economy goals.

Market Opportunity

Can Brand Recycling Goals Boost Green Polypropylene?

Global brands pushing for higher recycled content in packaging are driving demand for certified recycled polypropylene. This shift toward circular materials gives green polypropylene markers strong opportunities to supply sustainable, high quality resins.

Will New Recycling Rules Open Doors For Green Polypropylene?

Emerging regulations defining chemically recycled content are encouraging investment in advanced recycling. Creating new market access for compliant green polypropylene producers. This clarity supports growth and partnerships across sustainable polymer supply chains.

Limitations In The Green Polypropylene Market

- Limited availability and inconsistent quality of recycled and renewable feedstocks restrict the scalability of green polypropylene manufacture.

- Higher production costs compared to conventional polypropylene and challenges in achieving performance parity act as major barriers to wider adoption green polypropylene.

Green Polypropylene Market Segmentation Insights

Feedstock Type Insights

Which Feedstock Type Dominated The Green Polypropylene Market?

The mechanically recycled PP segment dominated the market in 2024. According to the source, mechanically recycled PP benefits from greater feedstock availability, established infrastructure, and easier traceability compared with newer technologies, which positions it as the mechanically recycled stream, combined the lower risk perceptions among converts and suppliers, supports its dominance in the current landscape of green polypropylene.

The chemically recycled/ depolymerised PP segment is set to experience the fastest rate of market growth from 2025 to 2034. This segment is gaining momentum because it offers higher quality recycled material closer of virgin resin performance, unlocking applications that were previously out of reach for recycled PP. as investments increase in chemical recycling technologies and policy frameworks strengthen around circular feedstock’s, chemically recycled PP is poised to scale rapidly. The combination of improved purity, broadening regulatory acceptance, ad rising brand owner commitments to recycled content is making this feedstock path particularly attractive for future growth.

Product Grade Type Insights

Is The Homopolymer Green PP Segment Dominant In Green Polypropylene Market?

The homopolymer green PP segment maintained a leading position in the market in 2024. Homopolymer green PP continues to dominate because it offers high stiffness and clarity, and is compatible with a wide variety of applications such as packaging, films and fibers areas where demand is robust. Also, many existing production and recycling systems are already configured for homopolymer grades, which lowers barriers to adoption and enables scale up more readily.

The copolymer green PP segment is expected to grow with the highest CAGR in the market during the period 2025 to 2034. Copolymer grades offer enhanced toughness, impact resistance and flexibility compared to homopolymer grades, making them suitable for more demanding applications such as automotive components and technical parts. As manufacturers seek greener materials that don’t compromise on part performance, copolymer green PP is increasing seen as a next generation option. Additionally, the evolution of recycling and bio-based feedstock is making it more feasible to produce copolymer grades from sustainable inputs, thereby unlocking new premium product tiers and application segment.

Application Type Insights

Is Packaging Segment Dominant In The Green Polypropylene Market?

The packagining segment dominated the market in 2024. Packagining remains dominant because it has the largest volume demand, is under the most consumer and regulator driven sustainability pressure, and benefits from more straightforward substitution with green PP variants. Brands and converts in packaging are among the earliest adopters of recycled or renewable polymers, mad because packaging formats often tolerate increment cost premiums for sustainability, green polypropylene finds string traction. The combination of high volume, regulatory scrutiny, and established recycling loops puts packaging at the forefront of green PP applications.

The automotive segment will gain a significant share of the market over the studied period of 2025 to 2034. Automotive is poised for fastest growth because vehicles are under increasing pressure to reduce weight and improve sustainability, creating demand for lightweight, recycled or bio-based plastics such as green polypropylene. Advanced polymer grades that combine low carbon footprint with high performance are especially relevant in automotive parts, interiors and under hood components. As the automotive industry’s material strategy evolves, green PP is becoming a key enabler in lightweighting, circular economy and emissions reduction goals.

Regional Insights

Why Is The Asia Pacific Region Driving The Green Polypropylene Market?

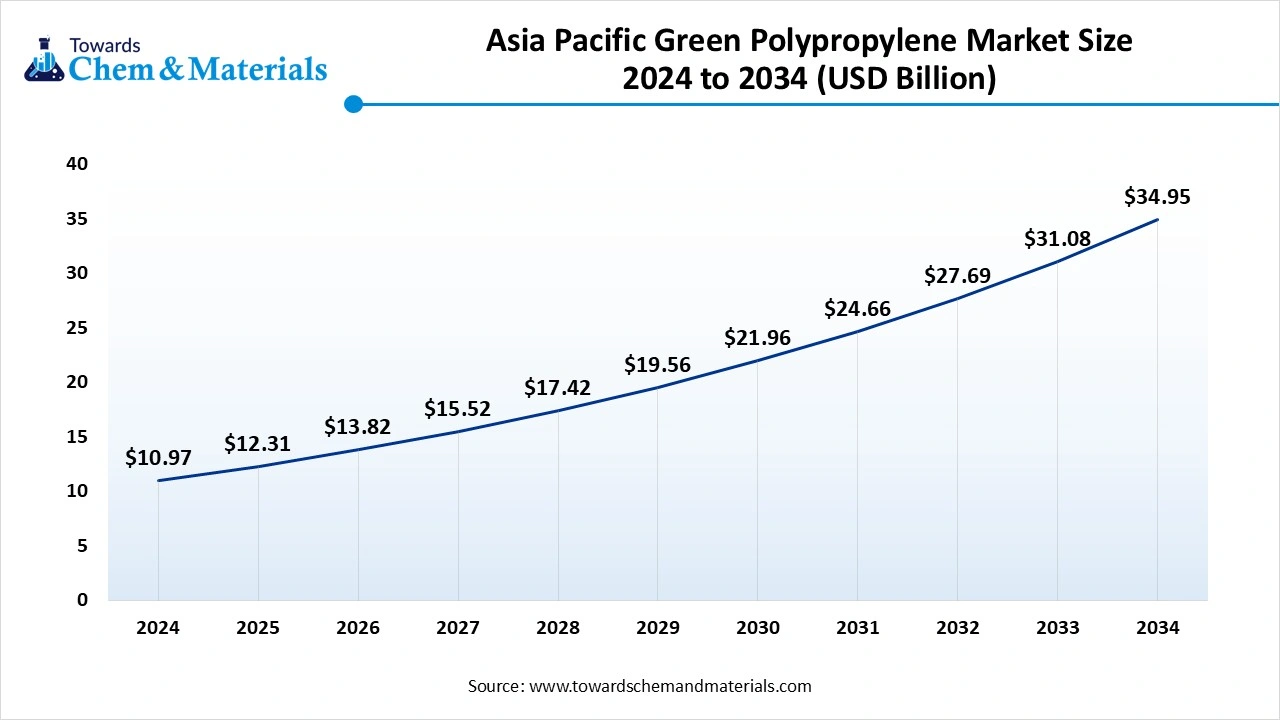

The Asia Pacific green polypropylene market size is estimated at USD 12.31 billion in 2025 and is projected to reach USD 34.95 billion by 2034, growing at a CAGR of 12.29% from 2025 to 2034. Asia Pacific dominated the market with a share of 50% in 2024.Asia Pacific dominated the market share of 48% in 2024.

The market is strangely supported by its vast plastics manufacturing infrastructure, robust automotive and packaging industries, and government policies favouring sustainable production. According to the insights, the region held roughly half of the market share in 2024, thanks largely to its capability to integrate larger scale recycling operations and a ready base of end use sectors that are shifting toward greener materials. The availability of low cost feedstocks, increasing investment in bio-refineries, and regulatory push toward circular economy practices further reinforce the region’s dominant position in green polypropylene.

China is emerging as a key driver within the green polypropylene market due to its large scale plastic production, strong governmental emphasis on sustainability, and rapid expansion of recycling and bio-based polymer technologies. The market commentary indicates that China’s focus on chemical recycling and renewable feedstock combined with its booming packaging, automotive and electronics sectors positions it as strategic hub for green polypropylene growth. This momentum is supported by national priorities for carbon neutrality, waste to resource policies and increasing investments in advanced polymer manufacturing, all of which reinforce China’s pivotal role in the green polypropylene ecosystems.

Why Is Europe Expected To Grow The Fastest In The Green Polypropylene Market?

Europe expects the fastest growth in the market during the forecast period, thanks to its strong regulatory framework and circular economy focus. The region’s policies on recycled content, low carbon materials and plastic waste reduction are making green PP a more strategic material choice for manufacturers. In particular, investment in chemical recycling, bio-based feedstocks and certification systems strengthens the supply chain for green polypropylene in Europe. As a major end use industry such as packaging and automotive shift toward lower carbon resins, Europe is poised to achieve the fastest growth rate in the green polypropylene segment.

Germany stands out in Europe’s green polypropylene landscape due to its advanced recycling infrastructure, strong automotive and manufacturing base, and leadership in materials innovation. Its companies are actively adopting bio-based and recycled polypropylene solutions to meet sustainability targets and serve high performance applications. With national emphasis on decarbonisation plastics and integrating circular economy models, Germany is becoming a key domestic market and technology hub for green polypropylene materials. This focus positions Germany as a dominant country within the European green polypropylene market.

Green Polypropylene Market Top Companies

- INEOS – Develops circular and renewable PP via mass-balance recycling and the NEXTLOOPP food-grade rPP project.

- TotalEnergies / TotalEnergies Corbion – Expands recycled and renewable PP output and promotes circular packaging partnerships.

- Neste – Supplies renewable propane feedstock enabling bio-based PP production with major carbon savings.

- Borealis / Borouge – Produces certified renewable PP using Neste’s bio-feedstock at European plants.

- Berry Global – Manufactures food-grade recycled PP through its CleanStream® technology and coalition initiatives.

- Indorama Ventures – Exploring bio-based and circular feedstocks that could extend into PP applications.

- Repsol – Markets Reciclex® PP grades with high recycled content for packaging and automotive use.

- Agilyx / Brightmark – Advance chemical recycling technologies converting waste PP into circular feedstock.

- Veolia – Builds large-scale recycling infrastructure supporting PP recovery and feedstock supply.

- Unilever / Nestlé – Create strong market demand for recycled and bio-based PP through sustainable packaging commitments.

More Insights in Towards Chemical and Materials:

- Polystyrene Market : The global polystyrene market volume was reached at 40.09 million tons in 2024 and is estimated to surpass around 62.33 million tons by 2034, growing at a compound annual growth rate (CAGR) of 4.51% during the forecast period 2025 to 2034.

- Biopolymers Market : The global biopolymers market size was valued at USD 19.85 billion in 2024, grew to USD 21.93 billion in 2025, and is expected to hit around USD 53.68 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.46% over the forecast period from 2025 to 2034.

- Liquid Crystal Polymers Market : The global liquid crystal polymers market size was valued at USD 1.99 billion in 2024, grew to USD 2.25 billion in 2025, and is expected to hit around USD 6.73 billion by 2034, growing at a compound annual growth rate (CAGR) of 12.95% over the forecast period from 2025 to 2034.

- Medical Fluoropolymers Market : The global medical fluoropolymers market volume was reached at 8.21 kilo tons in 2024 and is expected to be worth around 13.87 kilo tons by 2034, growing at a compound annual growth rate (CAGR) of 5.39% over the forecast period 2025 to 2034.

- Lignin-based Biopolymers Market : The global lignin-based biopolymers market size accounted for USD 1.32 billion in 2024 and is predicted to increase from USD 1.38 billion in 2025 to approximately USD 2.07 billion by 2034, expanding at a CAGR of 8.11% from 2025 to 2034.

- Fluoropolymers Market : The global fluoropolymers market volume is calculated at 639.21 kilo tons in 2024, grew to 688.89 kilo tons in 2025 and is predicted to hit around 1351.23 kilo tons by 2034, expanding at healthy CAGR of 7.77% between 2025 and 2034.

-

Water Treatment Polymers Market : The global water treatment polymers market volume was valued at 8,323.10 kilotons in 2024 and is estimated to reach around 15,477.50 kilotons by 2034, exhibiting a compound annual growth rate (CAGR) of 6.40% during the forecast period 2025 to 2034.

Bio-Based Polypropylene Market : The global bio-based polypropylene market stands at 49.18 kilo tons in 2025 and is forecast to reach 261.27 kilo tons by 2034, advancing at a 20.39% CAGR.

- Polypropylene Market : The global polypropylene market volume was reached at 87.21 million tons in 2024 and is expected to be worth around 135.05 million tons by 2034, growing at a compound annual growth rate (CAGR) of 4.47% over the forecast period 2025 to 2034.

- Polyethylene Market : The global polyethylene market volume is calculated at 113.2 million tons in 2024, grew to 117 million tons in 2025, and is projected to reach around 158.1 million tons by 2034.The market is expanding at a CAGR of 3.40% between 2025 and 2034.

- Polyethylene Terephthalate (PET) Market : The global polyethylene terephthalate (PET) market size was reached at 39.25 USD Billion in 2024 and is expected to be worth around 68 USD Billion by 2034, growing at a compound annual growth rate (CAGR) of 5.65% over the forecast period 2025 to 2034.

- Renewable Polypropylene Market : The global renewable polypropylene market size was valued at USD 58.85 billion in 2024 and is expected to hit around USD 133.67 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.55% over the forecast period from 2025 to 2034.

- Polypropylene Compounds Market : The global polypropylene compounds market size was approximately USD 23.89 billion in 2024 and is projected to reach around USD 50.86 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 7.85% between 2025 and 2034.

- U.S. Biopolypropylene Market : The U.S. Biopolypropylene market is expected to reach a volume of approximately 2,026.18 thousand in 2025, with a forecasted increase to 9,777.15 thousand by 2034, growing at a CAGR of 19.11% from 2025 to 2034.

- U.S. Polyolefin Compounds Market : The U.S. polyolefin compounds market volume was reached at 2.80 million tons in 2024 and is expected to be worth around 4.69 million tons by 2034, growing at a compound annual growth rate (CAGR) of 5.30% over the forecast period 2025 to 2034.

-

U.S. Polypropylene Market : The U.S. polypropylene market size was valued at USD 19.70 billion in 2024, grew to USD 20.49 billion in 2025 and is expected to hit around USD 29.11 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.98% over the forecast period from 2025 to 2034.

Green Polypropylene Market Top Key Companies:

- INEOS

- TotalEnergies / TotalEnergies Corbion

- Neste

- Borealis-Borouge / Borouge

- Berry Global

- Indorama Ventures

- Repsol

- Agilyx / Brightmark

- Veolia

- Unilever / Nestlé

- Genomatica / Gevo

Recent Developments

- In August 2025, the Vioneo group has selected Lummus Technology’s Novolen polypropylene technology for a new facility in Antwerp that will use green methanol feedstock and renewable hydrogen/electricity to produce fossil free polypropylene grades, highlighting the movement toward large scale, low-carbon PP production.

- In June 2025, Japan’s Mitsui Chemicals Inc. is reviewing a spin-off of its Basic and Green Materials unit, which includes polypropylene resin operations as part of its strategy to sharpen focus sustainable materials and circular economy segments.

Green Polypropylene Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Green Polypropylene Market

By Feedstock / Source

- Mechanical Recycled PP (rPP)

- Chemically Recycled / Depolymerized PP

- Bio-based / Renewable Feedstock

- Mass-balance / ISCC-certified co-processed PP

By Product Grade

- Homopolymer Green PP

- Copolymer Green PP

- Filled, Reinforced & Specialty Green PP

By Application

- Flexible & Rigid Packaging

- Automotive

- Consumer Goods & Appliances

- Textiles & Nonwovens

- Industrial & Construction

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5941

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.